Hi There!

I hope you are all well.

May I seek for your assistance for me to determine how can I do the setup which has the below requirement.

Scenario: In compliance with the PHL taxation, all goods/services availed by Senior Citizens should be VAT exempt but the vat that was deducted on the amount should also be presented on the receipt and transaction as a deduction on the amount of goods/services.

Example:

Item A (Tax inclusive amount): P112

If sold to Senior Citizen:

Item A: P112

12% VAT: 12

Amount to be paid by Senior Citizen: P100

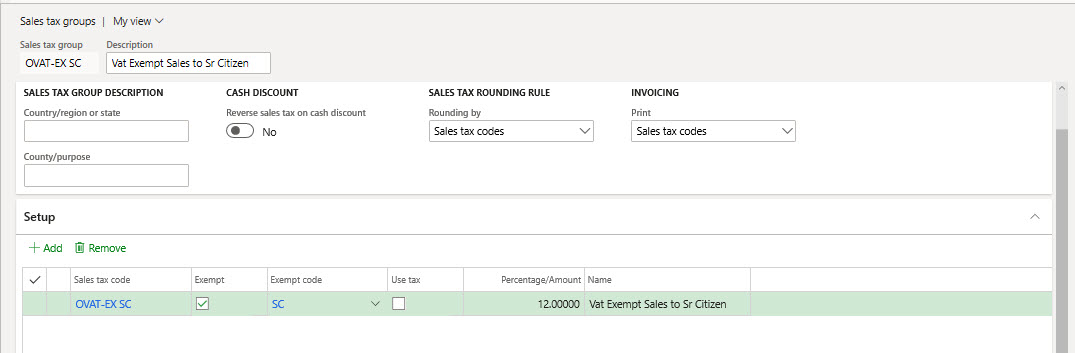

What we tried is to create a sales tax group and tick the box exempt on the added sales tax code on the setup section but we still assigned a VAT percent.

Result: No VAT was recorded and/or deducted on the journal created.